Internationalization of our universities is also a valorization issue

The benefits of internationalization far outweigh the drawbacks. But the academic community should be aware that a policy debate around those drawbacks has been ongoing for some time.

Five proposals for enforceable EU fiscal rules

Recently, the European Commission proposed a reform of the fiscal rules. However, reforming the rules is not enough; enforcement must also be improved. We present five recommendations for the enforcement of the Stability and Growth Pact.

Op-ed for Politico: It’s Groundhog Day for EU fiscal rule reform

As hawkish members seek to water down the Commission’s attempts to make the rules more sensible, the bloc will only end up going around in circles.

Criticism of Italian Fiscal Policy: Outdated and Unfounded

Dutch members of parliament like to criticize Italy. The country ought to implement more reforms. However, their arguments are based on persistent misunderstandings.

Suggestions for SGP Reform

In the paper, we very briefly sketch out the reform proposal put forward by the EU-Commission and make five suggestions on how this could be developed further. The annex contains two short papers covering (1) the EU methodology for computing debt sustainability and (2) expenditure rules in practice drawing on the Dutch experience.

Reforming the Stability and Growth pact: three suggestions to Commission proposal

The European Commission put forward a proposal to reform the European fiscal rules. The proposal is a step in the right direction. However, it fails to address a number of important shortcomings and it creates a number of new problems.

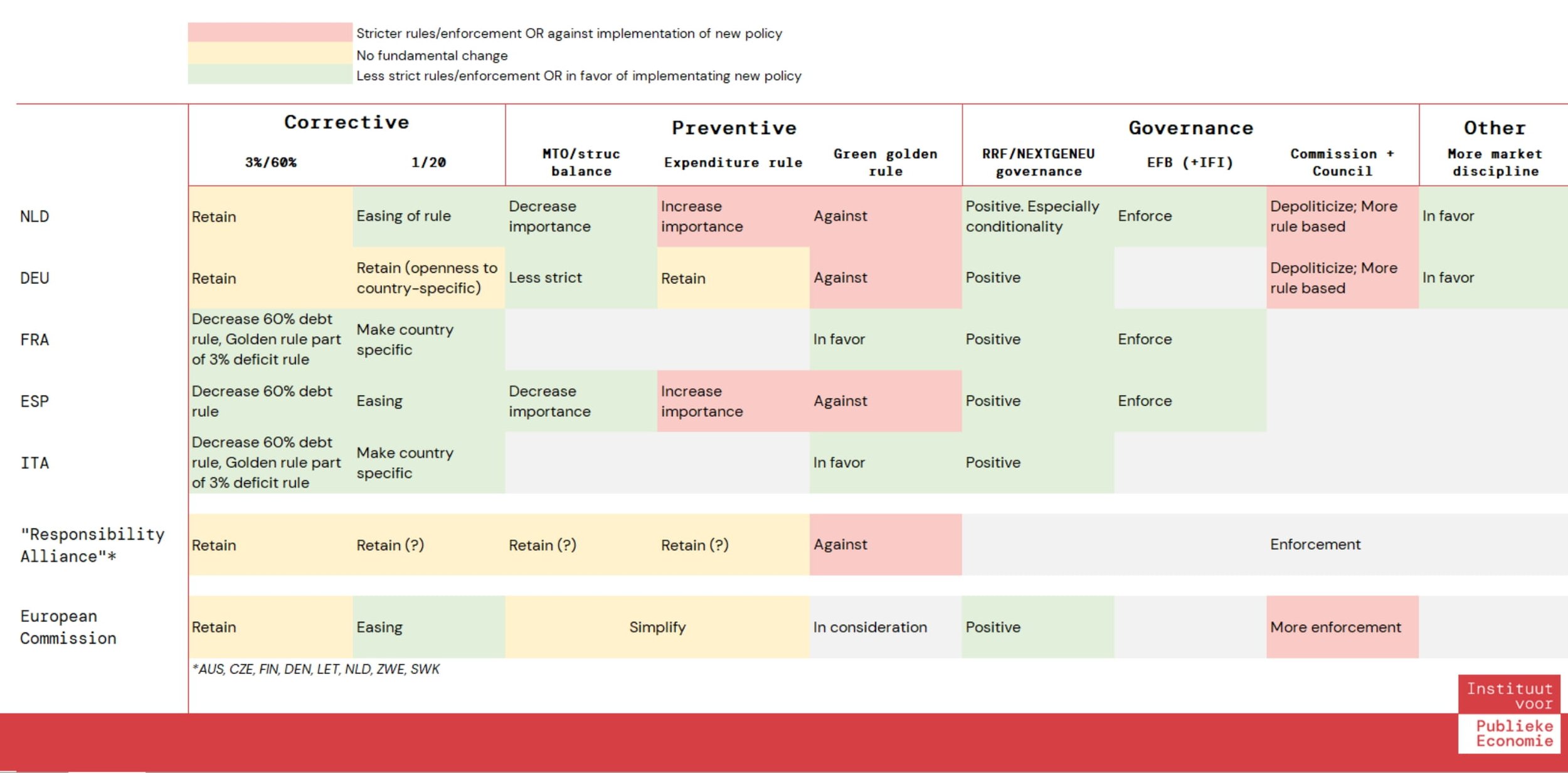

Infosheet: Member States’ positions on Stability and Growth Pact reform

We produced an overview of selected Member States’ positions on Stability and Growth Pact reform. Their positions seem to leave room for changes to the preventive arm, the debt reduction rule, and the governance framework.

Proposal addressing Preferential Tax Regimes for Newly Domiciled Taxpayers

A number of European countries grant personal income tax benefits to newly domiciled tax residents (typically ‘expats’ or retirees). Such schemes amount to a beggar-thy-neighbour policy and should not be applicable to EU residents.